Multi-channel to Omni-channel Retail Analytics: A Big Data Use Case

MULTI-CHANNEL is simply having multiple channels through which you buy, market, sell, and fulfill.

CROSS-CHANNEL has the ability to see all of a customer’s information across all channels enables more personalized offers based on their brand relationship.

OMNICHANNEL weaves all the touchpoints of the products and services of the brand into a seamless fabric of all phases of the customer’s brand experience.

Which one are you?

Let’s face it – The old uni-channel retail model is dying in some cases and changing in others. E-commerce is driving nearly all retail growth. Digital customers want simple, consistent, and relevant experiences across all channels, touchpoints, mobile screens, smart watches and other devices.

Gen Y and Millenial segments increasingly call the shots and success will be based on how well companies, and every frontline employee, decipher the growing disparity between “what they say” vs. “what they actually do.”

Focus on the user and all else will (or should) follow.

No brainer strategy right.. but cohesive multi and omni-channel experiences that are satisfying, fulfilling, and engaging are proving to be non-trivial to engineer or execute. Just watch Walmart as it plays catchup with Amazon.com. Or ask Sears, Best Buy, B&N, and others as they attempt to transform. Every retailer struggles to execute omni-channel and multi-screen initiatives in order to meet customer needs and drive maximum $ impact given scarce organizational resources.

Omni-channel digital platforms are not easy solutions to build or get right. Amazon.com took almost 15 years and $15+ billion in app+infrastructure investment to get to a low cost-to-serve digital model. Competing with them and trying to build an equivalent in 18 months, with even $500M investment, offshore low-cost developers etc. is an impossible task even for the likes of Walmart. They can do me-too things but new customer experience and engagement innovation is next to impossible.

Change is continuous. Just when firms think they have the omni-channel experience figured out they have to evolve to address the next mobile channel or social channels. There are more mobile-connected devices than there are people on earth. Typical mobile users check their screens more than 150 times a day. There are more than 1.4+ billion Facebook accounts across Facebook, Instagram and now WhatsApp. The half-life of a piece of content shared on social networks Twitter and Facebook is 3 hours.

The new customer experience battle is being fought around same-day delivery. Global companies are implementing local shopping: Google Shopping Express, AmazonFresh, eBay Now. Amazon is spending $15+ billion on new warehouses and offering same-day and Sunday delivery.

Next-generation omni-channel fulfillment is transforming execution and changing customer expectations. Some companies like Google are debuting same-day delivery service starting at $5.99 to cross-sell their Google Wallet. Other new offerings include WunWun, Instacart and TaskRabbit. Are retailers ready to compete? Can their systems support this across corporate, product, channel, and customer data ?

Execution rather than strategy is the management challenge. The challenge for large retailers is not just having a good strategy but efficient digital execution. The large retailers have an legacy apps, architectural IT and data analytics challenge that more nimble startups don’t. They often try to build comprehensive platforms a part of a wider strategic initiative which aims to support, provide and deliver digital services in the multi-channel, multi-device, multi-format, multi-sku, multi-language, multi-country and multi-culture world that they operate in. These mega-projects often fail.

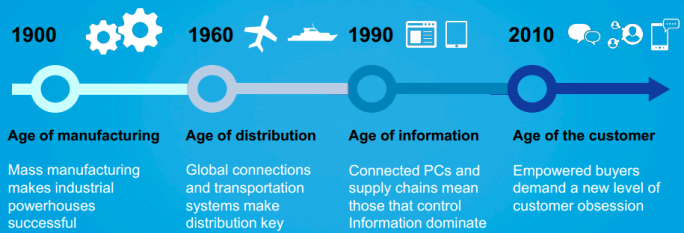

Digital Transformation of Retail Underway

In 1999, physical retailer Circuit City pioneered the option to buy a product online and pick it up in-store.

Today, as digital & mobile channels transform the customer experience and engagement, retailers like Best Buy, Lowes, Barnes and Noble, Saks, Macys, Nordstrom are very worried about becoming showrooms for online retailers.

This “showrooming” trend is a steady seismic shift and poses a strategic problem in consumer electronics, books, shoes, appliances where a growing number of consumers are going to retailers to test drive products and then go online with mobile phones to transact at a cheaper price elsewhere. Best Buy and others are in danger of turning into Amazon.com’s “showroom”, which has the advantage of low-touch self-service, and other lower overhead costs (e.g, automated warehouses).

To create shopper stickiness retailers are trying parallel engagement/fulfillment strategies (1) offering the buy online, pick up in-store or ship-to-store options; (2) price match; (3) same-day delivery options; (4) more “consulting” and shopping assistants.

Amazon.com, on the other side, is playing offense by increasing same day fulfillment, increasing distribution warehouse footprint and automation with the Kiva purchase (robotic fulfillment), and also partnering with brick-and-mortar footprint companies including Staples, RadioShack, and 7-Eleven, to place Amazon delivery lockers in stores.

Retail strategists and CEOs worry that we have reached a tipping point as mobile and Web compete with physical as viable alternative channels. Increasingly, a significant % of shoppers with smart phones use them to scan QR/barcode codes, get product availability and compare prices while in the store. Mike Duke, Wal‐Mart Stores CEO, has dubbed this a “new era of price transparency.” And to think we are in the early innings of SoLoMoMe (Social + Local + Mobile + Personalized).

To avoid the “browse but not buy” behavior in brick-and-mortar stores, new “dynamic customer experiences” strategies are emerging driven by predictive analytics to aggregate/leverage/act customer intelligence and drive more consumer loyalty. The goal — convert “lookers into buyers” or create new cross-channel experiences like “site -> store -> delivery pickup -> door” or “mobile web store”.

It is important to note that the shift towards an analytics driven experience or real-time reactive model is non-trivial for most retailers. Sears/K-mart hired a kick-ass analytics team but could not figure out how to link the analytical insight to offers or actions on the web or stores.

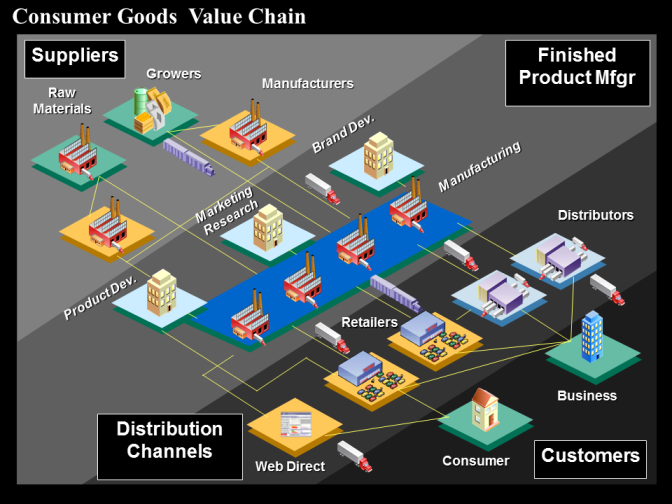

The transformational impact is going to be felt up and down the consumer goods industry value chain…. Analyzing Product SKU Data, Pricing Calculations by channel, or Behavior Analytics.

Multi-channel – Omni-channel – Multi-screen Experiences

“Macy’s, JCPenney, Sears, Deb Shops, RadioShack, and Wet Seal are among retailers closing thousands of stores over the next year.” — USA Today on March 16, 2015.

Where are physical store shoppers going? Retailing has evolved from single channel models to multi-channel to omni-channel to multi-screen experiences. Multi-channel meant retailers sold directly to the customer via more than one channel but they were isolated channel-centric silo’d experiences.

The state of the art is evolving into omni-channel, unified and integrated customer-centric experiences. In other words, simultaneously leveraging customer touchpoints — mobile, social, kiosks, store, etc, — to create a seamless experience.

The logic of omni-channel is simple… Customers don’t think in channels. They think in terms of getting stuff done easily, quickly and cheaply.

More recently, mobile is evolving into multi-screen strategies… how to serve customers across different – tablets, smartphones, dumbphones, and other form factor devices. Enabling channel surfing on steriods…seems to be the next wave. Mobile is the gateway to cross-channel shopping.

What is the role of analytics in this context? The shift toward contextual and behavior marketing is driven by data — big data.

The mining of consumer usage, social interaction, page views, mobile swipes is increasing driving user experience. Internet-based products and offers are getting improved and improvised as they get used. As these products get used at scale, they generate a lot of user behavioral data. This provides the opportunity to enhance these products as users use them and create analytics-driven learning products

This tends to transform product, marketing/offer creation life cycles in retail. Before you may have a product release every year, every two years, and you’re waiting for the next revision to be released with enhancements, whereas now it’s just happening faster and faster and in the case of Internet based products like Travel etc. all the time. Releases? There is no well-defined product release.

To enable this continuous response model… there are many different analysts and data scientists who analyze behavioral data, create different groupings of the data, create different aggregates of the data, look at different kinds of numbers on different user subpopulations and then glean insights from them. That’s what ultimately goes into improving the relevance of offers and products.

Why Omni-Channel and Multi-screen Retailing?

“As a shopper, your basic needs don’t change. But your behavior is dependent on the technology that’s around you.” Piers Fawkes, editor-in-chief of PSFK in Business Insider

Information‐hungry, price‐savvy, and mobile‐empowered shoppers expect a one-screen, one-store consistent experience across retail channels and touch points. This means a move from “connecting the channels” to “blending the channels.” The flipside… What data does the in-store associate, call center employee, merchandizer, and e-commerce manager need to quickly tailor information for the customer?

Omni-Channel label implies that retailers will be able to intelligently interact with customers across traditional and non-traditional channels—websites, physical stores, kiosks, direct mail and catalogs, call centers, social media, mobile devices, gaming consoles, televisions, advertising, home delivery, blogs and more. Figure below illustrates the size of the opportunity.

If traditional retailers hope to survive, they must embrace omni-channel retailing and also transform the one big feature Web retailers lack—stores and other customer contact points —from a liability into an asset. They must turn shopping into an entertaining, exciting, and emotionally engaging experience by skillfully blending the physical with the digital (Web, Mobile, Facebook).

Retailers have to evolve from outdated measures of success or KPIs, and become adept at rapid test-and-learn methodologies to deal with the new multi-channel and SoLoMo (social + local + mobile data) reality.

But this migration to omni-channel is going to very difficult for most retailers. The challenge is that retailers have too many locations, too little IT integration, and unsustainable cost structures to change quickly and overcome underperforming sales per square foot.

New Digital Experience Expectations

Consumers expect a one-screen, seamless experience across channels and touch points. Sounds simple but exceptionally hard to execute.

Being a truly omni-channel retailer means the consumer can choose whatever channel she wants to interact with, any device that she’d like to do that with, and still get a very convenient, consistent shopping experience. It also means being flexible…the transaction can start in one channel (e.g., browing in a store) and complete in another channel (e.g., purchase on a mobile device by scanning a QuickResponse code) seamlessly. The complex hand-offs between channels have to be invisible to the customer.

The first wave of multi-channel and omni-channel commerce was about establishing basic cross-channel transaction capabilities and foundations around a common product master or a 360° view of the customer. Essentially figuring out ways to leverage inventory across all those channels. Nordstrom has implemented their cross-channel inventory project effectively providing visibility into inventory trapped at the store level. Stores often operate like mini-warehouses… stuff often goes in and is never found again. Unlocking this inventory black-hole is a big deal for many brick-and-mortar retailers.

There are some interesting retail strategies emerging to engage customers… retailers can have a label with a QR code applied to plastic shopping baskets.

There are some interesting retail strategies emerging to engage customers… retailers can have a label with a QR code applied to plastic shopping baskets.

The QR code can attract customers to a promotional page on the retailer’s Web site that promotes reduced-price items—generally the weekly specials page.

The goal is “distract” or “attract” the customer from using their mobile phones to compare prices from other retailers / competitors.

But in today’s retailing environment, a simple focus on the integrated business processes isn’t enough. Just “more seamless process integration” isn’t enough to stop price erosion, decreasing basket sizes, lower response rates and places where private label may be increasing profitability but cannibalizing category or department sales.

So enter predictive analytics to address optimal offers based on Right Product / Right Price / Right Channel / Right Time. The next retail frontier is emerging around “getting ultra personal” – Offers, Products, Experience, and Campaigns built around a common “personalization and offer management” engine; the intelligence of the engine directly affecting increased conversions.

The goal is to leverage the shopping, spending, inventory data to make thousands of micro pricing, merchandize, and assortment decisions in a week instead of ten? The goal is to customize and deliver one hundred assortments to shopper segments, instead of ten? The goal is to predict one hundred stockouts about to occur, instead of ten?

The next wave is centered around omni-channel “speed to insight” analytics which essentially a big data use case.

Omni-channel Predictive Analytics

Who are my customers? Why do they buy from our brand, channel or device? How should the assortment be optimized across the channels or device? What experience do they value most about my brand? Simple questions but are extra-ordinarily complex to answer in a high velocity shopping environment.

Companies need the technology ‘power tools’ to gather, analyze and interpret thousands or millions of data strands of customer interaction detail from countless touch points, channels and data sources – cracking the DNA code of each customer and learning over time to communicate and build meaningful relationships.

To get insights a new breed of big data loyalty analytics is emerging… mine the massive piles of digital footprints or breadcrumbs customers and prospects leave across channels. loyalty data, Smart phone location data, e-commerce visits, social media likes, reviews, even location announcements like check-ins provide incredibly valuable insights into building predictive models.

Customers, cross-channel and cross-device, generate clues every day as they search, browse, friend, like, tweet, blog, shop, and buy on-line. the challenge for retailers is to find these answers hidden within those massive piles of digital clues. Omni-channel analytics is about understanding customers profiles in present new offers via more sophisticated targeting (see below…a modified version of a figure from MicroStrategy).

Omni-channel customer analytics help retailers extract value from data in order to understand who their customers are and what they value most about their brands by combining customers’ omni-channel behavioral data into a single platform of customer information for analytic reporting, behavioral segmentation and predictive modeling.

The omni-channel customer wants to (or expects to) use all channels simultaneously. Retailers using an omni-channel approach will track customers across all channels, not just one or two. Data driven tracking enables new capabilities: Check-ins, Push notifications, Location based coupons, QR/barcode scans for reviews and promotions.

Take for instance, analytical e-mail targeting. Macy’s and other retailers are taking it to another level. They are focused on targeted email offers based on consumers’ browsing history. According Macy’s CMO, “There are times we’ll send out 18 million unique emails … down to the point of [emailing a shopper with a message like]. We just saw you last night on the women’s shoes part of the website, and then send that shopper a targeted shoe promotion.” They can now do the same by looking at location data from mobile devices. If the customer was in a store but didn’t make a transaction then mail them a coupon. If the customer opts-in then Macy’s can send them a SMS or e-mail promotion while they are in the store. All this requires very fast matching powered by simple models.

Several retailers are racing to develop omni-channel analytics. At the National Retail Federation big show there was a case study around Omni-channel Analytics presented by Bass Pro Shops and IBM Netezza. Bass Pro provides fishing, hunting and outdoor enthusiasts a unique store experience which is part aquarium, education, conservation and entertainment center.

Source: IBM Netezza

Bass Pro has initiated an omni-channel customer analytics project, a joint IT/business initiative which aims to gave Bass Pro’s merchants and marketing teams unprecedented insight into customers’ needs and behavior using integrated customer, shopping and behavioral from every touchpoint and channels.

The type of analytics include: Traffic patterns, User demographics, Conversion & buying behavior, Traffic by category, Traffic by SKU, Device patterns (in the case of mobile), and Mobile Application downloads.

Why omni-channel analytics? Basically competition from specialty and general merchandise retailers in recent years is forcing firms like Bass Pro to develop a deeper understanding their customers needs and providing better products and shopping experiences across all their channels, including wholesale boats, wholesale firearms, stores, boat dealerships, restaurants, lodge, catalog and internet.

Big Data Platforms and Customer Behavioral Analytics

Catalina Marketing, a point of sale coupon marketing firm, has one of the largest loyalty database in the world. Catalina’s largest database contains three years’ worth of purchase history for 195 million U.S. customer loyalty program members at supermarkets, pharmacies, and other retailers. With 600 billion rows of data in a single table, it’s 2.5 petabytes.

Catalina Marketing use in-database analytics to understand each customer as an individual, or a market segment of one. Each coupon printed is unique to the individual customer. Predictive models are based on analysis of three years’ worth of purchase history for 195 million U.S. customer loyalty program members. Catalina’s coupons achieve redemption rates of 25% (a very high rate in coupon redemption).

While most organizations may not match the scale and complexity of Catalina’s data environment it is likely that every retailer CEO and business users are putting pressure on IT to help them get insights out of ever-larger data sets and to do this faster.

Every retailer wants to find answers hidden within the massive piles of shopping, spending, inventory, pricing and clickstream, promotion data they have. They want to gain a holistic view of their customers to answers business questions such as:

- Customers: Who are my customers by categories?

- Interaction Models: What are the ways customers buy different product categories with me? How can I use that insight to manage my business in an adaptable manner as my customers switch channels?

- Channels: How do my customers behave across a growing number of channels? Should I track customers at the household, individual, digital persona or touch-point level?

- Behavioral Segmentation: What are the action-driven behavioral attributes of my customers that best cluster them into segments?

- Responses: What is the propensity for my customers to respond across channels and product categories? How can I use that knowledge to interact real-time?

- Marketing Strategy: What is the effectiveness of my current marketing strategy? How can I optimize my investment approach?

- Marketing Execution: Who is in the market at a given time, what are they looking for, what should I communicate with them, and what is the right positioning strategy for them?

These are not new questions for retailers.

What is new is the ability to aggregate the data, analyze and slice-and-dice in real-time. Implementing optimized, streamlined next gen services require:

- Infrastructure and Application Platforms. Launching innovative options for retailers requires sophisticated infrastructure touching nearly every retail operational system. Some leading retailers have implemented sophisticated application architectures necessary for product visibility from the heart of the supply chain to the hands of the consumer. Even the best don’t have this perfected, as doing so is incredibly difficult and requires continuous transformation and change management. .

- Robust data. None of these services can be launched without significant technology improvements on the back-end for accurate data snapshots. It really is all about the data.Retailers will need an intense understanding of the inventory position to match with consumer facing data to execute. This involves everything from analyzing, trending, modeling data at the digital, store and distribution center level in all of the markets and across all demographics.

From what I saw at the NRF, retailers seem to be investing in data appliances (black box solutions) like IBM Netezza, Oracle Exadata and EMC Greenplum. Hadoop is now entering into the dialog. Netezza loads raw data and via BI platforms like SPSS and Cognos, delivers insights to the retail analyst.

The figure above from Aginity illustrates the type of things retailers are desperately trying to accomplish. The underlying technical requirements for any Omni-Channel solution include

- Data warehouse appliance to aggregate multiple streams

- ELT tools to extract-transfer-migrate – load

- Customer cross channel data model

- Data management tools for data sourcing, integration and ongoing maintenance

- Customer behavioral segmentation and analytics

- Reporting utilities

- Interactive visualization tools

- Web Services architecture for integration with any downstream applications

Not a trivial puzzle to architect for any retailer. What makes it complicated is that the underlying infrastructure (plumbing) for omni-channel strategies is evolving.

One issue that retailers are facing right now: How do you select among the black-box appliance vendors? What are the pros and cons of a Hadoop strategy vs. a proprietary strategy? We will illustrate how to address these questions.

Bottom-line

“The world belongs to those that are adaptive learners” – Brian Dunn, ex-CEO Best Buy

Top buzzword in retail is Omni-Channel. Most brands today interact with their consumers across different channels and touch-points – Web, Kiosks, Call Centers, Stores, Mobile, Social etc. It is not enough for brands to operate subsets of these channels as independent “silos” as consumers expect to be treated to an orchestrated experience across these different touch-points.

Omni-channel is being accelerated by the rapid rise of mobile shoppers. Mobile has reached the tipping point so retailers are being forced to react and think strategically as consumers expect a unique and personal experience. Brick‐and‐mortar retailers must optimize their in‐store and mobile experiences to feed information‐hungry, price‐savvy, mobile‐empowered shoppers.

A successful omni-channel strategy should not only guarantee a retailer’s survival—no small matter in today’s environment—but also deliver a revolution in customers’ expectations and experiences.

The challenge is to use data and analytics to find ways to re-engage customers on more than just price, to make shopping in various channels a more stimulating and satisfying experience, rather than just another trip to pick up whatever is on sale.

Notes and References

1) Macy’s Doubles Down on Its ‘Omnichannel’ E-Commerce Future — See full article from DailyFinance:http://srph.it/j4saYz — Macy’s is bullish on omni-channel. Online sales for the department store chain grew more than 30% in 2010, and Macy’s is heavily investing in infrastructure upgrades, such as e-commerce product fulfillment centers, to support an acceleration of that advance.

2) Omni-Channel Retailing Page – http://en.wikipedia.org/wiki/Omni-channel_Retailing

3) Shoppers who scope out merchandise in stores but buy on rivals’ websites, usually at a lower price, have become the bête noir of many big-box retailers. The trend, known as “showrooming,” hurts the bottom lines of traditional stores while benefiting online-only retailers such as Amazon.com Inc., which have the advantage of lower overhead costs and mostly can skirt the collection of sales tax.

3) Predictive Analytics Infrastructure is not cheap. Just as an illustration consider The Cost of Oracle Exadata Database Machine X2-8 Posted on September 30, 2010 by Eric Guyer

- All in, a full rack X2-8 is likely to cost about $3.9M, including first year maintenance. Subsequent years of maintenance will be around $700k annually. That puts us at around $6.6M across 5 years on a TCO basis. Keep in mind that software maintenance lives forever and accounts for two-thirds of the annual fee.

4) Another cost illustration – Industry analysts suggest Netezza customers pay $20,000 per terabyte. So if you have a petabyte of data, you can do the math. The price of specialized data appliances while justified in some cases has opened the door for lower cost alternatives like Hadoop on commodity clusters.

5) According to McMillanDoolittle, LLP: World class retailers have to deliver the following 8C’s:

- Convenience – Right Locations and Channels

- Consistency — across time and channels

- Clarity — Right Positioning

- Choice — selection and unique experience

- Communication – personalized and crisp

- Control – purpose

- Connection – relevant and meaningful

- Cast – in-store, call center team members

6) 9 Trends That Are Transforming The Retail World

The Web has transformed retail in the first wave….e-commerce was the second wave….search and comparison shopping was the next wave…. mobile is the beginning of the fourth onslaught of change…brands and retailers are being forced to be more efficient, channel agnostic and invest in analytics capability to differentiate.

Multi-channel strategies “connect the channels” — they ensure that whatever mobile, social or other digital platform customers occupy, the brand and all it represents — from inspiration to transaction — is present.

Omni-channel is a step further…. to achieve success in an retail environment where channel boundaries are hard to pinpoint, retailers will need to “blend the channels” by recognizing how digital technologies influence purchases across all channels.

7) Retail Use Case Enablers – Data Sciences -> Mathematical Techniques -> Computing Tools -> Vertical/Horizontal Analytics

Related articles

- Omni-Channel Conversion Optimization via Social Marketing/Media Analytics

- Big Data Investment Theme – Fidelity Investments (practicalanalytics.wordpress.com)

- Big Data Analytics: Trends to Watch For in 2012 (allthingsd.com)

- http://blog.shop.org/ — interesting news/articles on retail e-commerce

- Omni-Channel on Wikipedia

- How Companies Learn Your Secrets (New York Times February 16, 2012)

- The Walgreens path to omnichannel success

- Nordstrom disses omni-channel, but Alexandra Mysoor says it’s real (pandodaily.com)

- Good resource…. Ecomm Comp. Center: http://bit.ly/cdoecomhm

- IBM/Deloitte research: http://tinyurl.com/retailtfibm

Trackbacks & Pingbacks

- Big Data Analytics Use Cases | Business Analytics 3.0

- Apple IOS 6 Passbook: Enabling SoLoMoMe + Omni-channel Analytics | Business Analytics 3.0

- The World After Apple Stores | Growth Ninja

- e-Commerce, Mobile and Omni-Channel, where next?

- Reclaim Your Edge: How Advanced Analytics Is Helping Macy’s Transform the Customer Experience

- Multi-channel to Omni-channel Retail Analytics: A Big Data Use Case | RetailFit | Scoop.it

- Multi-channel to Omni-channel Retail Analytics: A Big Data Use Case | Cross- & Omni-channel | Scoop.it

- Multi-channel to Omni-channel Retail Analytics:...

- Multi-channel to Omni-channel Retail Analytics:...

- Multi-channel to Omni-channel Retail Analytics:...

- BigData Analytics » How Fashion Retailer Nordstrom Drives Innovation With Big Data Experiments

- Shopatron Launches First API-based Customer Care Program Powered by Enterprise-Level Order Management, Extending … | quiverssoftware

- Multi-channel to Omni-channel Retail Analytics:...

- The Retail Paradox: the Curse of Digital | Business Analytics 3.0

- Omni Channel Marketing-Learn it from Albert. | NRUNA's Blog

Hi Ravi – great article – I think you must have seen our 8C’s model at NRF – please don’t leave out CAST (store team) which is the 8th C and very important as customers interact with retail team members in stores, via chat or via a call center.

LikeLike

Thanks Mara. I updated the reference.

LikeLike

Omni-channel is evolving….With Mobile….we are seeing multiple strategies – tablets, smartphones, dumbphones, devices. This is also termed Multi-Screen strategies by folks like Larry Page @ Google.

LikeLike

Hi Ravi – great article on the retail trends, fun to read and good references. Can you please suggest the reference for the first diagram suggesting rise of social media > 78%, who conducted this study and when?

Will be closely following your thoughts.

Thanks,

Pankaj

LikeLike

Pankaj – it was a Neteeza/IBM article. The data is probably outdated by now as the social media space is evolving so quickly.

LikeLike

online Retailers growth rate is 15%? … wow.. that’s in comparison to 2% growth in retail overall.

Here’s a good article I found about how firms such as Retalon are using Predictive Analytics to help save Brick-and-Mortar retailers:

http://www.sdcexec.com/article/10924667/retail-outlook-not-just-business-as-usual-any-more?utm_source=SDCE+Newsletter&utm_medium=email&utm_campaign=SDCE130

LikeLike

Good Article. Omni channel retailing is also significant in Telecom where the player own stores, web, mobile app, mobile web & social.

LikeLike

@Ravi, thank you for this excellent post; you really dive into some of the details around omni-channel, so I honored this post as a “foundation reference” in the Ecommerce Competency Center at the Chief Digital Office.

Related, I just published a long riff on IBM’s superb “Winning Over the Empowered Consumer, Why Trust Matters” report, and I’d love your take on one of my insights. I’ve advised some large retail brands on social business transformation and analyzed 1000s of interactions. I predict that firms that undertake omni-channel without addressing the “Producer/Consumer Divide” will underperform. Briefly, since customers with social tools are a smart crowd, they amplify the fact that they care less about products/services than about the outcomes that they create by using products/services. That’s the consumer side. The producer loves products and talks about products but doesn’t appreciate the importance of outcomes. They aren’t speaking the same language. Retailers can break through by aligning their focus with customers’: focus on personal individualized service with the aim of helping customers achieve superior outcomes in situations in which their products/services are used. This means reimagining retail and the attitude toward products, but I predict it’s the key to breaking through.

Omni-channel often represents huge technology and process investment, and by itself I predict it will produce incremental improvement. Kind of like a guy who rents a Ferrari and a table at the most exclusive restaurant to get the trophy girl whom he really doesn’t know. Unless there’s a gut connection, what IBM calls “trust,” firms’ results will be lackluster. But omni+reimagining is breakthrough.

Links: Ecomm Comp. Center: http://bit.ly/cdoecomhm

Riff w links to IBM/Deloitte research: http://tinyurl.com/retailtfibm

LikeLike

Thanks a lot for this great post. Its very valuable post.

LikeLike

As for looking information about multichannel eCommerce solutions, i found meaningful information with the best.

Characteristic Multi-channel to Omni-channel Retail Analytics. Incredible Ravi Kalakota!

LikeLike

you forgot Qlikview under tools

LikeLike

Very good information. Lucky me I came across your site by accident (stumbleupon).

I have saved as a favorite for later!

LikeLike

Excellent article. I will be going through some of these issues as

well..

LikeLike

Hi Ravi, Excellent and insightful article. Wonderfully captured all the complicated nuances of omni!

LikeLike

Various retail companies are using big data analytics to get into the beneficiary impact of the workdone throughout. Thanks for the various Information.

LikeLike