Big Data Fatigue and Company Shakeout?

Big Data is the latest “next big thing” transforming all areas of business, but amid the hype, there remains confusion about what it all means and how to create business value.

Big Data is the latest “next big thing” transforming all areas of business, but amid the hype, there remains confusion about what it all means and how to create business value.

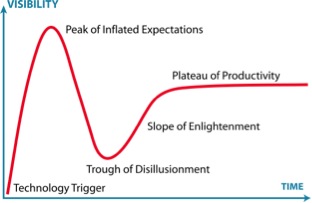

Usually when there is so much hype…there is an inevitable boom-bust-boom cycle. Hence my question: Is the Big Data shakeout inevitable?

Are we in a big data tech bubble? If you are an enterprise customer, how do you prepare for this? What strategies do you adopt to take advantage of the situation? Can you move from lab experiments to production deployments with confidence?

The sheer number of companies that are chasing “the pot of big data gold” is astounding (see below). While the innovation has accelerated the ability of the typical Fortune 1000 enterprise to absorb and assimilate has not. They tend to be 5-10 years behind the curve. As a result, many big data startups are either running out of cash or they are being folded by VCs into other firms. This boom-bust cycle is a typical pattern in innovation.

http://www.bigdata-startups.com/open-source-tools/

Source: Big Data Universe v3.. Matt Turck, Sutian Dong & FirstMark Capital

The Case of Drawn to Scale

Drawn to Scale, the four year-old startup behind Spire, shut down recently. Co-founder and CEO Bradford Stephens announced the news in a blog post. Drawn to Scale raised .93M in seed funding.

Spire is a real-time database solution for HBase that lets data scientists query Hadoop clusters using SQL. According to Stephens, the system has been by deployed by American Express, Orange Flurry, and four other companies.

Drawn to Scale showed that its technology was viable in enterprise environments and established a “presence against competitors who raised 10-100x more cash,” but even that wasn’t enough to save the startup from its financial woes.

As Hadoop evolves and different layers of the data analytics stack get commoditized, specialized vendors like Drawn to Scale will have problems surviving. SQL-on-Hadoop was a unique feature set…but over time it has become a must-have feature, that is becoming embedded in the stack – e.g., Impala in Cloudera CDH stack. As a result, firms like Drawn to Scale once unique functionality becomes difficult to monetize.

Startup to Viable Ventures

The Big Data ecosystem is exploding with exciting start-ups, new divisions and new initiatives from established vendors. Everyone wants to be the vendor/platform of choice in assisting firms deal with the data deluge (Data growth curve: Terabytes -> Petabytes -> Exabytes -> Zettabytes -> Yottabytes -> Brontobytes -> Geopbytes), translate data to information to insight, etc.

In both U.S and Europe, several billion dollars of venture money has been invested in the past three years alone in over 300+ firms. Firms like Splunk had spectacular IPOs. Others like Cloudera and MapR have raised gobs of money. In the MongoDB space alone – a small market of less than 100M total revenue right now, over $2 Billion is said to have been invested in the past few years.

An interesting sampling of start-up vendors and the amount of venture capital each has raised, including lead investors is listed at Wikibon (we reproduced the list below). This list includes only Big Data pure-plays delivering products and/or services in one of the following markets: Hadoop, NoSQL, Next Generation (MPP) Data Warehousing, predictive analytics and/or advanced data visualization.

A narrow slice of the Big Data Market but illustrates the vibrant big data startup activity taking place. This list doesn’t include all the Social Intelligence and Analytics firms that are living off Facebook or Twitter data that represent a different slice of Big Data. Several hundred firms easily in that segment alone.

The temporal clustering of major innovations under the banner of big data is definitely one of the catalysts for the next wave of innovation and economic growth. We have seen this pattern before where advances in technology have combined to bring about a series of coordinated technological transformations that are correlated with waves of investment and business efficiency. (Joseph Schumpeter’s studied these business cycle patterns in the 1930s. These were later labeled creative destruction in innovation management circles.)

Most recently we saw this innovation pattern in the late 1990s around e-commerce. Thousands of new companies were created, bought, and merged during the 1997 – 2000. At the end of the cycle we saw a massive creative destruction period with a washout that lasted from late 2000 to end of 2003.

My hypothesis is that in 2013/2014 we are going to see a similar shakeout pattern around Big Data and Social Intelligence/Analytics. The evidence… we have too many startup companies chasing customers. Most of the projects are low-cost ($100K or less) or free pilots. Enterprise customers who are innovative are piloting technologies to understand the business value but are having a hard time moving these into production deployments.

The shakeout will start slowly but will pickup pace towards the end of this year. The catalyst for creative destruction is always the same – lack of next round of funding, lack of enterprise customers, declining valuations that prompt investors to pull back, and finally big established firms like Oracle, SAP and others moving to protect their turf by creating fear, uncertainty and doubt.

So what does this mean if you are a Big Data startup firm? It means managing your funding aggressively and making sure it lasts till you get paying customers. A simply analogy – a car with gas in the tank will win always against another car that is running out of gas.

What does this mean if you are an enterprise customer? Create a roadmap and continuously learn. If you are in the experimental mode, it’s ok to do several pilots. But make sure you are learning something and bringing this knowledge back into the organization. I see a lot of companies that are doing interesting pilots but have no plans to assimilate, scale or leverage the insights. So lot of effort is wasted.

What does this mean if you are a CIO? investing in cutting edge technologies could potentially lead to incredible rewards, but also come with risks. Project failure could be fatal in some high profile cases. CIOs are putting their reputation on the line everytime a new product is rolled out the enterprise.

Birth and death of firms is a natural phenom in entrepreneurship. The boom-bust-boom cycle is not a question of if but when. The survivors in Big Data will be those that are actively planning for the impending shakeout and acquiring assets – customers, technology, IP, patents — from the weaker players.

Big Data Start-up Ecosystem

Innovation in Big Data – Hadoop, NoSQL, Next Generation (MPP) Data Warehousing, predictive analytics and/or advanced data visualization… How many of these will survive?

Consolidation via mergers/acquisitions has already started. Vertica (HP), Kitenga (Dell), Salesforce.com (Buddymedia, Radian6), Oracle (Vitrue), EMC (Greenplum), IBM (spent over $15bln+ so far in aquisitions).

If you know of other firms that should be added to this list…

|

Big Data Start-up Funding by Vendor (adapted from Wikibon) |

||||

| Vendor | Founded | Funding (in $US mil.) | # of Institutional Rounds | Investors |

| Palantir | 2004 | $301 | 7 | SAC Capital, The Founders Fund, Glynn Capital, In-Q-Tel, Reed Elsevier Ventures, Ulu Ventures, Youniversity Ventures and Jeremy Stoppelman |

| Cloudera | 2008 | $146 | 5 | Accel Partners, Greylock Partners, Ignition Partners, In-Q-Tel and Meritech Capital Partners |

| Mu Sigma | 2004 | $133 | 2 | General Atlantic and Sequoia Capital |

| Opera Solutions | 2004 | $84 | 1 | Silver Lake Sumeru, Accel-KKR, Invus Financial Advisors, JGE Capital and Tola Capital |

| 10gen | 2008 | $81 | 6 | Intel Capital, Red Hat, New Enterprise Associates, Sequoia Capital, Flybridge Capital and Union Square Ventures |

| Guavus | 2006 | $78 | 3 | Investor Growth Capital, QuestMark Partners, Intel Capital, Artiman Ventures and Sofinnova Ventures |

| ParAccel | 2005 | $73 | 5 | Amazon, Menlo Ventures, Mohr Davidow Ventures, Bay Partners, Walden International, Tao Venture Capital Partners and Silicon Valley Bank |

| Talend | 2005 | $61.6 | 5 | Silver Lake Partners, Balderton Capital, Galileo Partners and IDInvest Partners |

| GoodData | 2007 | $53.5 | 3 | Andreesen Horowitz, General Catalyst, O’Reilly AlphaTech Ventures, Windcrest Partners, Tenaya Capital and Next World Capital |

| Splunk | 2003 | $40 | 3 | Ignition Partners, August Capital, JK&B and Sevin Rosen Funds |

| DataStax | 2010 | $38.7 | 3 | Meritech Capital, Lightspeed Venture Partners, Sequoia Capital and Crosslink Capital |

| 1010data | 2000 | $35 | 1 | Norwest Venture Partners |

| Couchbase | 2009 | $31 | 3 | Ignition Partners, Accel Partners, Mayfield Fund, and North Bridge Venture Partners |

| MapR | 2009 | $29 | 2 | Redpoint Ventures, Lightspeed Venture Partners and NEA |

| Tidemark | 2011 | $28 | 2 | Andreesen Horowitz, Redpoint Ventures and Greylock Partners |

| Factual | 2007 | $27 | 1 | Andreesen Horowitz and Index Ventures |

| Platfora | 2011 | $25.7 | 2 | Battery Ventures, Andreessen Horowitz, Sutter Hill Ventures and In-Q-Tel |

| MetaMarkets | 2010 | $23 | 2 | Khosla Ventures, IA Ventures, AOL Ventures, Neu Venture Capital, Joshua Stylman, Village Ventures and True Ventures |

| Hopper | 2007 | $22 | 3 | Atlas Venture, OMERS Ventures and Brightspark Ventures |

| Lattice Engines | 2006 | $21.6 | 2 | Battery Ventures and New Enterprise Associates |

| SumoLogic | 2010 | $20.5 | 2 | Sutter Hill Ventures, Greylock Partners, Shlomo Kramer |

| Hortonworks | 2011 | $20 | 1 | Benchmark Capital, Yahoo and Index Ventures |

| RainStor | 2004 | $19.2 | 3 | Storm Ventures, Doughty Hanson Technology Ventures, Informatica, Rogers Venture Partners and The Dow Company |

| DataXu | 2009 | $18.8 | 2 | Menlo Ventures, Atlas Venture and Flybridge Capital Partners |

| Datameer | 2009 | $17.8 | 3 | Kleiner Perkins Caufield & Byers and Redpoint Ventures |

| Revolution Analytics | 2007 | $17.6 | 2 | North Bridge Venture Partners and Intel Capital |

| Hadapt | 2010 | $16.2 | 1 | Atlas Venture, Norwest Venture Partners and Bessemer Venture Partners |

| Lucid Imagination | 2007 | $16 | 2 | Shasta Ventures, Granite Ventures, In-Q-Tel and Walden International |

| Continuity | 2011 | $12.5 | 2 | Andreessen-Horowitz, Ignition Ventures, Battery Ventures, Data Collective and Amplify Partners |

| Connotate | 2000 | $12.3 | 2 | Castile Ventures, Prism VentureWorks and .406 Ventures |

| ClearStory Data | 2012 | $12.25 | 1 | Kleiner Perkins Caufield & Byers, Andreessen Horowitz, Google Ventures and Khosla Ventures |

| Karmasphere | 2005 | $11 | 2 | Presidio Ventures, Hummer Winblad and US Venture Partners |

| Loggly | 2009 | $10 | 1 | True Ventures, Trinity Ventures, Matrix Partners |

| AgilOne | 2012 | $10 | 1 | Mayfield Fund |

| Oragami Logic | 2012 | $8 | 1 | Accel Partners |

| Alpine Data Labs | 2010 | $7.5 | 1 | Sierra Ventures, Mission Ventures, Sumitomo Corporation Equity Asia and Stanford University |

| SpaceCurve | 2009 | $7.5 | 1 | Triage Ventures, Reed Elsevier Ventures and Divergent Ventures |

| ParStream | 2008 | $5.6 | 1 | Khosla Ventures, Baker Capital, Crunch Fund, Data Collective and Tola Capital |

| SpaceCurve | 2011 | $5.2 | 2 | Reed Elsevier, Divergent Ventures, and Triage Ventures |

| MemSQL | 2011 | $5 | 1 | First Round Capital, SV Angel, Y Combinator, IA Ventures and Ashton Kutcher |

| WibiData | 2010 | $5 | 1 | New Enterprise Associates, SV Angel, Mike Olson and Eric Schmidt |

| InsightSquared | 2010 | $4.5 | 1 | Atlas Venture, Bessemer Venture Partners, NextView Ventures and salesforce.com |

| Chartio | 2010 | $4.4 | 1 | Avalon Ventures, Bullpen Capital, Y Combinator, Crosslink Capital and Jeff Hammerbacher |

| Trifacta | 2012 | $4.3 | 1 | Accel Partners, X/Seed Capital, Data Collective LLC, Dave Goldberg, Venky Harinarayan and Anand Rajaraman |

| Digital Reasoning | 2000 | $4.2 | 2 | In-Q-Tel and Silver Lake Sumeru |

| SiSense | 2008 | $4 | 1 | Opus Capital, Genesis Partners and Eli Farkash |

| Calpont | 2000 | $3.27 | 1 | Austin Ventures and GF Private Equity |

| StackIQ | 2006 | $3 | 1 | Anthem Venture Partners and Avalon Ventures |

| Zettaset | 2009 | $3 | 1 | Draper Fisher Jurvetson and Epic Ventures |

| Bidgely Energy analytics platform |

2012 | $3 | `1 | Khosla Ventures |

| Ginger.io | 2012 | $6.5 million in series A | 1 | Khosla Ventures, True Ventures and Romulus Capital. |

| GridGain | 2005 | $2.5 | 1 | RTP Ventures |

| NGDATA | 2011 | $2.5 | 1 | ING, Sniper Investments, Plug and Play Ventures |

| Sqrrl | 2012 | $2 | 1 | Atlas Venture |

| Feedzai | 2008 | $2 | 1 | Espirito Santo Ventures and Novabase Capital |

| Nodeable | 2011 | $2 | 1 | True Ventures and Matrix Partners |

| RelateIQ | 2012 | $1.25 | 1 | Accel Partners, Morgenthaler and SV Angel |

| Zoomdata | 2012 | $1.1 | 1 | Hemang Gadhia |

| AppEnsure | 2011 | $1 | 1 | Citrix Accelerator, TiE, Ignition Partners |

| DataHero | 2012 | $1 | 1 | Neu Venture Capital, The Foundry Group, David G. Cohen and Tasso Argyros |

| Drawn to Scale | 2009 | $0.93 | 1 | RTP Ventures, IA Ventures, and SK Ventures |

| Openera is a Canadian big data startup in the storage management | Dec 2012 | 250K | 1 | |

Multi-Year Opportunity for Services vendors

Business Analytics is the one of the fastest growing opportunities in the IT market. Few areas that enable new revenue streams from expanded solutions portfolio and higher margin deals through services opportunities. Opportunity exists to help drive unprecedented growth and demand for service offerings and delivers customer ROI.

The demand for analytics is certainly there. See chart below.

While the Big Data startup market will undoubtedly go through some consolidation over the coming 18 to 36 months, there is reason to be optimistic. The Big Data phenomenon is a long-term digital transformation trend that will affect how we live, work and enjoy. It continue to impact enterprise customers across nearly all industries. Vendors who emerge victorious from this period of disillusionment will find an enormous growth market for the next ten years or more as corporations begin to embrace and push the envelope of Big Data in improving their businesses.

Related articles

- The Daily Startup: Accel Leads Investment in Cloudera, as Hadoop Wave Rolls On (blogs.wsj.com)

- Early stage investment picks up in India: VCs spent 30% less in 2012, Blume most active VC (nextbigwhat.com)

- Wikibon

- Techcrunch

- Exclusive: Cloudera Closes Massive $65 Million Funding Round at $700 Million Valuation (allthingsd.com)

- http://pinterest.com/bigdatabbq/big-data-startups/

Hi Ravi,

Thank you for your blog entry. You’ve really detailed all the startups in big data and the exciting new turn for storage. Good job!

At the moment, I’m looking for bloggers and contributors for a storage and big data website. Would you perhaps be interested in contributing your past and future blog articles? We want this website to be a thriving community of experts generating conversations on big data, cloud computing and storage virtualization.

It’s free to join, and only the title and the first few sentences of your blog entries will be published on the website. We want readers to engage with your content and be directed to your blog for the full article. This way, you’ll get traffic! 🙂

If you’re interested or have any questions, please send me an email at tinajin [at] atomicreach.com with “Tech” in the subject line. I’ll be glad to answer any questions and get you started on being an expert contributor!

Sincerely,

Tina Jin

LikeLike