Robotic Process Automation + Analytics

“Looking to the future, the next big step will be for the very concept of the “device” to fade away. Over time, the computer itself—whatever its form factor—will be an intelligent assistant helping you through your day. We will move from mobile first to an AI first world.” — Sundar Pichai, CEO Google

- A global oil and gas company has trained software robots to help provide a prompt and more efficient way of answering invoicing queries from its suppliers.

- A large US-based media services organization taught software robots how to support first line agents in order to raise the bar for customer service.

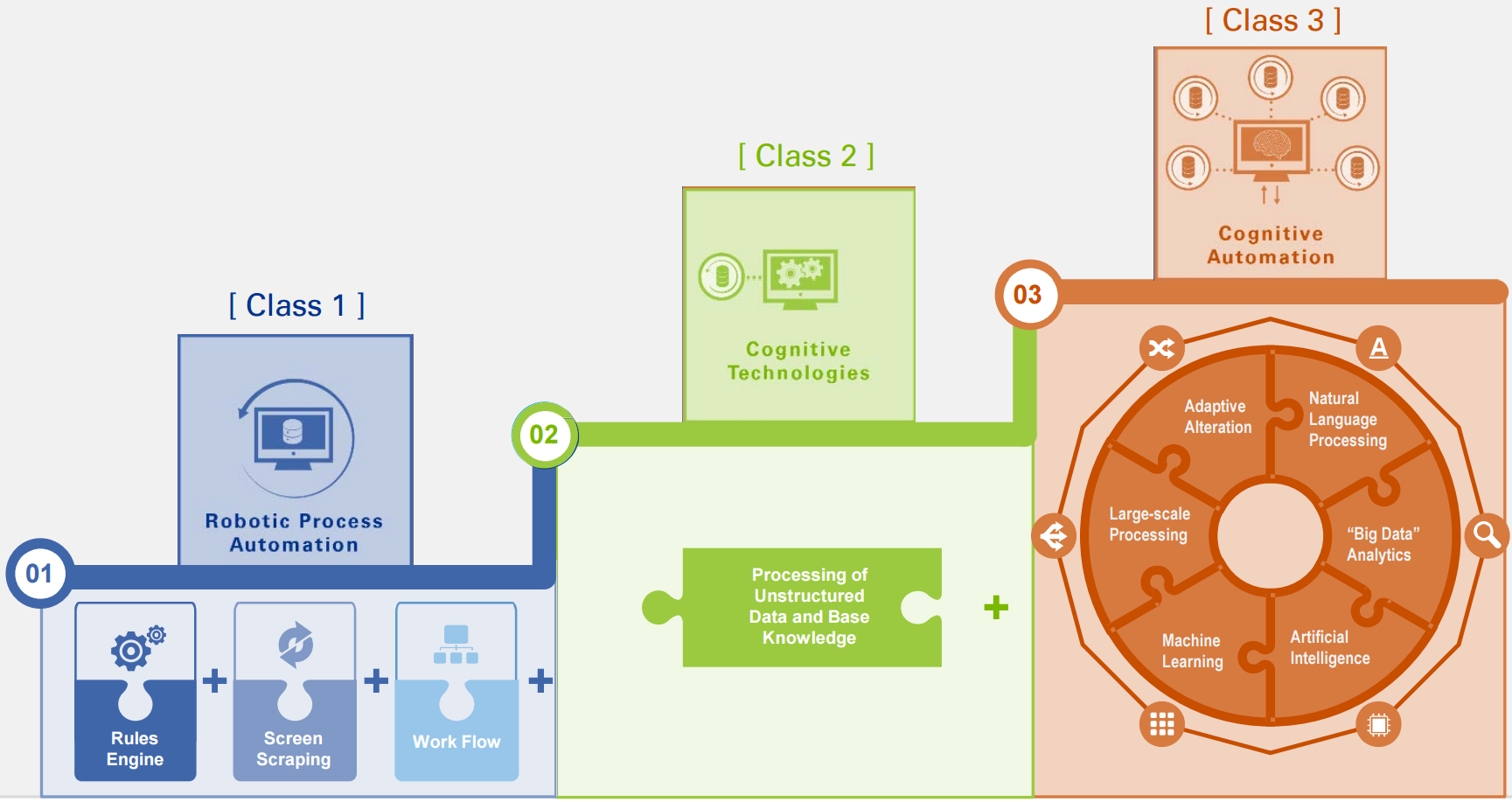

Software agents or Robotic process automation (RPA) is becoming a mainstream topic at leading corporations. I have seen a massive uptick in corporate strategy work in this area as C-Suite execs look at new ways to do more with less.

Software robots ∼ Conversational-AI products like Apple Siri, Microsoft Cortana, IBM Watson, Google Home, Alexa, drones and driverless cars ∼ are now mainstream. What most people are not aware of is the rapidly advancing area of enterprise robots to create a “virtual FTE workforce” and transform business processes by enabling automation of manual, rules based, back office administrative processes.

This emerging process re-engineering area is called Robotic process automation (RPA).

Machine Learning (ML) and graph processing are becoming foundations for the next wave of advanced analytics use cases. Speech recognition, image processing, language translation have gone from a demo tech to everyday use in part because of machine learning. Machine learning models, e.g., in driverless cars, teaches itself how to discover relevant things like a stop sign with snow partially obscuring the sign.

The market opportunity of artificial intelligence has been expanding rapidly, with analyst firm IDC predicting that the worldwide content analytics, discovery and cognitive systems software market will grow from US$4.5 billion in 2014 to US$9.2 billion in 2019, with others citing these systems as catalyst to have a US$5 trillion – US$7 trillion potential economic impact by 2025.

RPA – What?

“Robotic automation refers to a style of automation where a machine, or computer, mimics a human’s action in completing rules based tasks.” – Blue Prism

RPA is the application of analytics, machine learning and rules based software to capture and interpret existing data input streams for processing a transaction, manipulating data, triggering responses and driving business process automation around enterprise applications (ERP, HRMS, SCM, SFA, CRM etc.).

RPA is not a question of “if” anymore but a question of “when.” This is truly the next frontier of business process automation, enterprise cognitive computing, predictive analytics and machine learning. To make a prediction, you need an equation and parameters that might be involved.

Industrial robots are remaking blue-collar factory and warehouse automation by creating higher production rates and improved quality. RPA, simple robots and complex learning robots, are revolutionizing white-collar business processes (e.g. customer service), workflow processes (e.g., order to cash), IT support processes (e.g., auditing and monitoring), and back-office work (e.g., data entry).

I strongly believe that as cognitive computing slowly but surely takes off, RPA is going to impact process outsourcers (e.g., call center agents) and labor intensive white collar jobs (e.g., compliance monitoring) in a big way over the next decade. Any company that uses labor on a large scale for general knowledge process work, where workers are performing high-volume, highly transactional process functions, will save money and time with robotic process automation software.

Business Impact of RPA – Where?

Fan Engagement and Wearables: Disney MyMagic+

A satisfying experience is the driver of any business’s revenue growth. Disney Theme Parks is no exception. Disney is executing a guest (and fan) personalization strategy leveraging wearables (and analytics) to track, measure and improve the overall park experience. The goal is increase sales, return visits, word of mouth recommendations, loyalty and brand engagement across channels, activities, and time.

A satisfying experience is the driver of any business’s revenue growth. Disney Theme Parks is no exception. Disney is executing a guest (and fan) personalization strategy leveraging wearables (and analytics) to track, measure and improve the overall park experience. The goal is increase sales, return visits, word of mouth recommendations, loyalty and brand engagement across channels, activities, and time.

Wearables are the next big thing. The new crop of gadgets — mostly worn on the wrist or as eyewear — will become a “fifth screen,” after TVs, PCs, smartphones, and tablets.

Wearables are already being used to monitoring vital signs, wellness and health. Devices like Fitbit, UP, Fuelband, Gear2 track activity, sleep quality, steps taken during the day. Consumers of all sorts — fitness buffs, dieters, and the elderly — have come to rely on them to capture and aggregate biometric data.

What most people don’t understand is how powerful wearables (coupled with analytics) can be in designing new user experiences. Businesses thrive when they engage customers by creating a longitudinal predictive view of each customer’s behavior. To understand the wearables use cases and potential we did a deep dive into a real-world application at Disney Theme Parks.

Wearable Computing at Disney: MyMagic+

2014 Year in PreReview for Big Data Analytics

In the movie “Minority Report,” set in 2054, Tom Cruise plays the captain of the “PreCrime” police force, which uses “precognitive” abilities of mutants to stop crime before it happens. Silicon Valley futurists have sometimes used this reference in the context of the art of the possible with Big Data. We have another 40 years to go to see how analytics can accurately forecast future events based on human behavior. Meanwhile, imagining the future with some level of accuracy is within our reach today.

Tom Cruise plays the captain of the “PreCrime” police force, which uses “precognitive” abilities of mutants to stop crime before it happens. Silicon Valley futurists have sometimes used this reference in the context of the art of the possible with Big Data. We have another 40 years to go to see how analytics can accurately forecast future events based on human behavior. Meanwhile, imagining the future with some level of accuracy is within our reach today.

Value creation in the data economy made headlines in 2014. While Big Data continued to be the buzzword of the year in 2014, solutions that created economic impact were center stage. Trending terms such as “predictive analytics” and “advanced analytics” approached the levels of “Big Data” on Google Trends during the year. “ROI,” which was vaguely referenced in the last two years, became the most commonly used term with Big Data in 2014. Here is a cross-section of 2014 events.

Apple announces TopsyTV

This is their next-generation TV appliance that integrates social media engagement with the TV watching experience. Earlier in 2013, Apple acquired Topsy Labs, a reseller for Twitter content for $200M. This was followed by a series of less publicized acquisitions of social media data companies. Apple is characteristically tight-lipped about its plans for monetizing this product with advertising, but speculation is rife that Apple is poised to get a piece of the $600 billion that is spent on advertising today.

Data Monetization: Turning Data into $$$

The billion dollar question facing executives everywhere:

The billion dollar question facing executives everywhere:

- How do I monetize my data? How do we turn data into dollars?

- What small data or big data monetization strategies should I adopt?

- Which analytical investments and strategies really increase revenue?

- What pilots should I run to test data monetization ideas out?

Data Monetization is the process of converting data (raw data or aggregate data) into something useful and valuable – help make decisions (such as predictive maintenance) based on multiple sources of insight. Data monetization creates opportunities for organizations with significant data volume to leverage untapped or under-tapped information and create new sources of revenue (e.g., cross-sell and upsell lift; or prevention of equipment breakdowns).

But, data monetization requires a new IT clock-speed that most firms are struggling with. Aberdeen Research found that the average time it takes for IT to complete BI support requests, with traditional BI software, is 8 days to add a column to a report and 30 days to build a new dashboard. For an individual information worker trying to find an answer, make a decision, or solve a problem, this is simply untenable. For an organization that is trying to differentiate itself on information innovation or data-driven decision making, it is a major barrier to strategy execution.

To speed up insight generation and decision making (all elements of data monetization) business users are bypassing IT and investing in data visualization (Tableau) or data discovery platforms (Qlikview). These platforms help users ask and answer their own stream of questions and follow their own path to insight. Unlike traditional BI that provides dashboards, heatmaps and canned reports, these tools provide a discovery platform rather than a pre-determined path.

Also companies like Marketo which create marketing automation software are getting into the customer engagement and data monetization game. Their focus is to enable marketing professionals find more future customers; to build, sustain, and grow relationships with those buyers over time; and to cope with the sheer pace and complexity of engaging with customers in real time across the web, email, social media, online and offline events, video, e-commerce storefronts, mobile devices and a variety of other channels. And in many companies, marketing knits these digital interactions together across multiple disconnected systems. The ability to interact seamlessly with customers across multiple fast-moving digital channels requires an engagement strategy enabled by data and analytic insights.

RegTech – Regulatory/Risk Data Management, AML, and KYC Analytics

Everyone is abundantly aware of the changing risk and regulatory landscape within the financial services industry.

Everyone is abundantly aware of the changing risk and regulatory landscape within the financial services industry.

Over the past seven years, we’ve seen a massive regulatory overhaul and an industry-wide push to enhance trust and confidence and encourage investor participation in the financial system.

To roadmap Wall Street regtech priorities, we have been having ongoing meetings with MDs and leading architects in global banks and investment services firms. RegTech (e.g., regulation as a service) is a subset of FinTech. Companies include

- Fintellix offers a data analytics platform allowing banks to convert internal data into regulatory reporting formats

- Suade offers banks “regulation as a service” interpreting real time regulatory knowledge so that banks can better manage and respond to regulation

- Sybenetix combines machine learning with behavioral science to create a compliance and performance tool for traders

No longer business as usual. It is clear that banks are devoting more resources to Know Your Customers (KYC), Anti-Money Laundering (AML), fraud detection and prevention, Office of Foreign Assets Control (OFAC) compliance. FINRA is at the beginning stages of the process for building the Consolidated Audit Trail, or CAT for trading surveillance.

To enable compliance with variety of Risk/Regulatory initiatives, AML and KYC initiatives…the big RegTech related investments are:

- Strengthening the Golden Sources – Security Master, Account Master and Customer Master.

- Standardized, common global business processes, data, systems and quantitative solutions that can be leveraged and executed across geographies, products, and markets to manage delinquency exposures, and efficiently meet Regulatory requirements for Comprehensive Capital Analysis and Review (CCAR), FDIC Reporting, Basel, and Stress Loss Testing.

- Various enterprise data management initiatives – Data Quality, Data Lineage, Data Lifecycle Management, Data Maturity and Enterprise Architecture procedures.

Regulatory reporting improvements via next generation Enterprise Datawarehouses (EDW) (using Oracle, IBM, NoSQL or Hadoop)– Reporting on top of EDW addresses the core problems faced by Finance, Risk and Compliance when these functions extract their own feeds of data from the product systems through which the business is conducted and use differing platforms of associated reference data in support of their reporting processes.

Lot of current investments are in the areas of Finance EDW which delivers common pool of contracts, positions and balances, organized on an enterprise wide basis and completed by anointed “gold” sources of reference data which ensure consistency and integration of information.

Crawl, walk, Run seems to be the execution game-plan as the data complexity is pretty horrendous. Take for instance, Citi alone….has approximately 200 million accounts and business in 160+ countries and jurisdictions. All risk management is made incredibly complex by the numerous banking mergers that took place over the past 3-4 decades.

The type of data challenges global banks like Citigroup, Goldman, Wells Fargo, Bank of America and JP MorganChase are wrestling with include: Read more

What is a “Hadoop”? Explaining Big Data to the C-Suite

Keep hearing about Big Data and Hadoop? Having a hard time explaining what is behind the curtain?

Keep hearing about Big Data and Hadoop? Having a hard time explaining what is behind the curtain?

The term “big data” comes from computational sciences to describe scenarios where the volume of the data outstrips the tools to store it or process it.

Three reasons why we are generating data faster than ever: (1) Processes are increasingly automated; (2) Systems are increasingly interconnected; (3) People are increasingly “living” online.

As huge data sets invaded the corporate world there are new tools to help process big data. Corporations have to run analysis on massive data sets to separate the signal from the noisy data. Hadoop is an emerging framework for Web 2.0 and enterprise businesses who are dealing with data deluge challenges – store, process, index, and analyze large amounts of data as part of their business requirements.

As huge data sets invaded the corporate world there are new tools to help process big data. Corporations have to run analysis on massive data sets to separate the signal from the noisy data. Hadoop is an emerging framework for Web 2.0 and enterprise businesses who are dealing with data deluge challenges – store, process, index, and analyze large amounts of data as part of their business requirements.

So what’s the big deal? The first phase of e-commerce was primarily about cost and enabling transactions. So everyone got really good at this. Then we saw differentiation around convenience… fulfillment excellence (e.g., Amazon Prime) , or relevant recommendations (if you bought this and then you may like this – next best offer).

Then the game shifted as new data mashups became possible based on… seeing who is talking to who in your social network, seeing who you are transacting with via credit-card data, looking at what you are visiting via clickstreams, influenced by ad clickthru, ability to leverage where you are standing via mobile GPS location data and so on.

The differentiation is shifting to turning volumes of data into useful insights to sell more effectively. For instance, E-bay apparently has 9 petabytes of data in their Hadoop and Teradata cluster. With 97 million active buyers and sellers they have 2 Billion page view and 75 billion database calls each day. E-bay like others is racing to put in the analytics infrastructure to (1) collect real-time data; (2) process data as it flows; (3) explore and visualize. Read more

Oracle’s Analytics-as-a-Service Strategy: Exalytics, Exalogic and Exadata

Following the success of its Exadata (database as a service) and Exalogic (middleware-as-a-service) engineered systems, Oracle unveiled Exalytics Business Intelligence at Oracle OpenWorld 2011.

Following the success of its Exadata (database as a service) and Exalogic (middleware-as-a-service) engineered systems, Oracle unveiled Exalytics Business Intelligence at Oracle OpenWorld 2011.

The goal of these appliances (engineered systems) is to help IT groups further shrink data center costs, increase system utilization and enable better application integration. All goals that CIOs everywhere continue to struggle with. CIOs now face an interesting decision matrix: Exalytics/Logic/Data systems versus traditional build from components versus hosted.

With ExaSystems, Oracle has a tremendous market advantage. Oracle owns most of the software that enterprises need today. Via acquisitions, Oracle owns the whole stack! Web tier, Middleware, Database software, Database tier, Storage tier. With Sun Microsystems it’s ideally positioned to maximize the platform capabilities. It’s easy for Oracle make its own software play nice on the Exalytics, Exalogic and Exadata platforms.

Wanted: CIO – BI/Analytics

In a tough economy, a new tech-fueled BI and analytics arms race is on to create the next competitive advantage.

In a tough economy, a new tech-fueled BI and analytics arms race is on to create the next competitive advantage.

Everyone is beginning to look beyond the status quo in BI, analytics, Big Data, Cloud Computing etc to fundamentally change how they discover fresh insights, how they can make smarter decisions, profit from customer intelligence and social media, and optimize performance management.

The headache for corporations is not the technology aspects but the leadership side. Who is going to lead this effort, corral the vendors and formalize and execute a more structured program.

Who is going to lead the effort to create the right toolset, dataset, skillset and mindset necessary for success?

As BI and Analytics moves from “experiment and test” lab projects to commercial deployments, companies are going to need more leadership and program management capabilities. They need leadership that can provide strategic, expert guidance for using powerful new technologies to find patterns and correlations in data transactions, event streams, and social media.

Some firms are making moves. In insurance, AIG – Chartis Inc. unit appointed Murli Buluswar to the new post of chief science officer. This aims to enhance Chartis’ focus on analytics… he “will be responsible for establishing a world-class R&D function to help improve Chartis’ global commercial and consumer business strategies and to deliver more value for customers.” This focus on analytics involves “asking the right questions and making science-driven decisions about strategies—whether it’s related to underwriting decisions, product innovation, pricing, distribution, marketing, claims or customer experience—with the end result of improving the scope of what Chartis delivers for customers”.

As a result of where we are in the maturity cycle and to support the business units better, we are seeing a new emerging role “CIO – BI” that is dotted lined to the global CIO or a shared services leader. Let’s look at a representative job posting from GE Capital, which always seems to be a step ahead of most companies. Read more

The Curious Case of Salesforce and Workday: Data Integration in the Cloud

The growing enterprise adoption of Salesforce SFA/CRM, Workday HR, Netsuite ERP, Oracle on Demand, Force.com for apps and Amazon Web Services for e-commerce will result in more fragmented enterprise data scattered across the cloud.

The growing enterprise adoption of Salesforce SFA/CRM, Workday HR, Netsuite ERP, Oracle on Demand, Force.com for apps and Amazon Web Services for e-commerce will result in more fragmented enterprise data scattered across the cloud.

Automating the moving, monitoring, securing and synchronization of data is no longer a “nice-to-have” but “must-have” capability.

Data quality and integration issues — aggregating data from the myriad sources and services within an organization — are CIOs and IT Architects top concern about SaaS and the main reason they hesitate to adopt it (Data security is another concern). They have seen this hosted data silo and data jungle problem too many times in the past. They know how this movie is likely to unfold.

Developing strategic (data governance), tactical (consistent data integration requirements) or operational (vendor selection) strategies to deal with this emerging “internal-to-cloud” data quality problem is a growing priority in my humble opinion. Otherwise most enterprises are going to get less than optimal value from various SaaS solutions. Things are likely to get out of control pretty quickly. Read more