The NoSQL and Spark Ecoystem: A C-Level Guide

New Technologies | New Possibilities

As a C-level executive, it’s becoming clear to me that NoSQL databases and Machine Learning toolsets like Spark are going to play an increasingly big role in data-driven business models, low-latency architecture & rapid application development (projects that can be done in 8-12 weeks not years).

The best practice firms are making this technology shift as decreasing storage costs have led to an explosion of big data. Commodity cluster software, like Hadoop, has made it 10-20x cheaper to store large datasets.

After spending two days at the leading NoSQL provider MongoDB World event in NYC, I was pleasantly surprised to see the amount of innovation and size of user community around document centric databases like MongoDB.

Data Driven Insight Economy

It doesn’t take genius to realize that data driven business models, high volume data feeds, mobile first customer engagement, and cloud are creating new distributed database requirements. Today’s modern online and mobile applications need continuous availability, cost effective scalability and high-speed analytics to deliver an engaging customer experience.

We know instinctively that there is value in all the data being captured in the world around out…no question is no longer “if there is value” but “how to extract that value and apply it to the business to make a difference”.

Legacy relational databases fail to meet the requirements of digital and online applications for the following reasons:

Big Data Fatigue and Company Shakeout?

Big Data is the latest “next big thing” transforming all areas of business, but amid the hype, there remains confusion about what it all means and how to create business value.

Big Data is the latest “next big thing” transforming all areas of business, but amid the hype, there remains confusion about what it all means and how to create business value.

Usually when there is so much hype…there is an inevitable boom-bust-boom cycle. Hence my question: Is the Big Data shakeout inevitable?

Are we in a big data tech bubble? If you are an enterprise customer, how do you prepare for this? What strategies do you adopt to take advantage of the situation? Can you move from lab experiments to production deployments with confidence?

The sheer number of companies that are chasing “the pot of big data gold” is astounding (see below). While the innovation has accelerated the ability of the typical Fortune 1000 enterprise to absorb and assimilate has not. They tend to be 5-10 years behind the curve. As a result, many big data startups are either running out of cash or they are being folded by VCs into other firms. This boom-bust cycle is a typical pattern in innovation.

http://www.bigdata-startups.com/open-source-tools/

Source: Big Data Universe v3.. Matt Turck, Sutian Dong & FirstMark Capital

The Case of Drawn to Scale

Drawn to Scale, the four year-old startup behind Spire, shut down recently. Co-founder and CEO Bradford Stephens announced the news in a blog post. Drawn to Scale raised .93M in seed funding.

Spire is a real-time database solution for HBase that lets data scientists query Hadoop clusters using SQL. According to Stephens, the system has been by deployed by American Express, Orange Flurry, and four other companies.

Drawn to Scale showed that its technology was viable in enterprise environments and established a “presence against competitors who raised 10-100x more cash,” but even that wasn’t enough to save the startup from its financial woes.

As Hadoop evolves and different layers of the data analytics stack get commoditized, specialized vendors like Drawn to Scale will have problems surviving. SQL-on-Hadoop was a unique feature set…but over time it has become a must-have feature, that is becoming embedded in the stack – e.g., Impala in Cloudera CDH stack. As a result, firms like Drawn to Scale once unique functionality becomes difficult to monetize.

Startup to Viable Ventures

The Big Data ecosystem is exploding with exciting start-ups, new divisions and new initiatives from established vendors. Everyone wants to be the vendor/platform of choice in assisting firms deal with the data deluge (Data growth curve: Terabytes -> Petabytes -> Exabytes -> Zettabytes -> Yottabytes -> Brontobytes -> Geopbytes), translate data to information to insight, etc.

In both U.S and Europe, several billion dollars of venture money has been invested in the past three years alone in over 300+ firms. Firms like Splunk had spectacular IPOs. Others like Cloudera and MapR have raised gobs of money. In the MongoDB space alone – a small market of less than 100M total revenue right now, over $2 Billion is said to have been invested in the past few years.

New Tools for New Times – Primer on Big Data, Hadoop and “In-memory” Data Clouds

Data growth curve: Terabytes -> Petabytes -> Exabytes -> Zettabytes -> Yottabytes -> Brontobytes -> Geopbytes. It is getting more interesting.

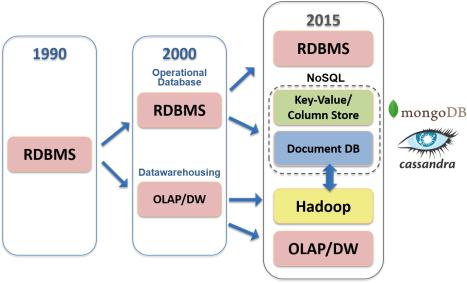

Analytical Infrastructure curve: Databases -> Datamarts -> Operational Data Stores (ODS) -> Enterprise Data Warehouses -> Data Appliances -> In-Memory Appliances -> NoSQL Databases -> Hadoop Clusters

———————

In most enterprises, whether it’s a public or private enterprise, there is typically a mountain of data, structured and unstructured data, that contains potential insights about how to serve their customers better, how to engage with customers better and make the processes run more efficiently. Consider this:

In most enterprises, whether it’s a public or private enterprise, there is typically a mountain of data, structured and unstructured data, that contains potential insights about how to serve their customers better, how to engage with customers better and make the processes run more efficiently. Consider this:

- Online firms–including Facebook, Visa, Zynga–use Big Data technologies like Hadoop to analyze massive amounts of business transactions, machine generated and application data.

- Wall street investment banks, hedge funds, algorithmic and low latency traders are leveraging data appliances such as EMC Greenplum hardware with Hadoop software to do advanced analytics in a “massively scalable” architecture

- Retailers use HP Vertica or Cloudera analyze massive amounts of data simply, quickly and reliably, resulting in “just-in-time” business intelligence.

- New public and private “data cloud” software startups capable of handling petascale problems are emerging to create a new category – Cloudera, Hortonworks, Northscale, Splunk, Palantir, Factual, Datameer, Aster Data, TellApart.

Data is seen as a resource that can be extracted and refined and turned into something powerful. It takes a certain amount of computing power to analyze the data and pull out and use those insights. That where the new tools like Hadoop, NoSQL, In-memory analytics and other enablers come in.

What business problems are being targeted?

Why are some companies in retail, insurance, financial services and healthcare racing to position themselves in Big Data, in-memory data clouds while others don’t seem to care?

World-class companies are targeting a new set of business problems that were hard to solve before – Modeling true risk, customer churn analysis, flexible supply chains, loyalty pricing, recommendation engines, ad targeting, precision targeting, PoS transaction analysis, threat analysis, trade surveillance, search quality fine tuning, and mashups such as location + ad targeting.

To address these petascale problems an elastic/adaptive infrastructure for data warehousing and analytics capable of three things is converging:

- ability to analyze transactional, structured and unstructured data on a single platform

- low-latency in-memory or Solid State Devices (SSD) for super high volume web and real-time apps

- Scale out with low cost commodity hardware; distribute processing and workloads

As a result, a new BI and Analytics framework is emerging to support public and private cloud deployments.