Gartner says – Business Analytics a $14.1 Bln market

The term “business intelligence” (BI) dates back to 1958, when IBM researcher Hans Peter Luhn coined the term in an IBM Journal article.

The term “business intelligence” (BI) dates back to 1958, when IBM researcher Hans Peter Luhn coined the term in an IBM Journal article.

However, it took until 1980s when decision support systems (DSS) became popular and mid 1990s for BI started to emerge as an umbrella term to cover software-enabled innovations in performance management, planning, reporting, querying, analytics, online analytical processing, integration with operational systems, predictive analytics and related areas.

Gartner 2014 magic quadrant shows the key players in the BI market. The different players are differentiated based on five abilities— ability to handle large volumes of data, ability to deal with data velocity, variety (structured and unstructured), visualization capabilities and domain/vertical specific accelerators.

Market Evolution

Analytics is becoming three different markets. First of all, there is the BI market which is actually going through quite a bit of change itself. This is a more consolidated market than we have seen in the past and there is a tremendous amount of work being done by Oracle, SAP, IBM and others to kind of retool it for the next generation of BI. So it is a growing market, lots of upgrade, replatform, modernization demand, lots of clients who are finally realizing that the tools (visualization etc.) are ready to give them some of the capability that they have historically cared about.

The second part of the market is what is called Advanced Analytics. Here you need PhD level data scientists who have backgrounds in machine learning, industry specific domain modeling, and different types of data science who can apply that in a very specific way to specific industry problems. This is a rapidly growing part of IT Services. Also, there are just not enough data scientists to go around.

The third part of the market is Analytics as a Service. This is about leveraging software-as-a-service platforms as opposed to on-premise. This is about a business model that is more like Business Process Outsourcing (BPO). Clients buy business outcomes; they don’t buy transactions and FTEs.

The analytics market has thousands of boutique consultants who are specialists in particular industries or specific technologies. It includes all the major technology providers, who are all trying to advance their business and capabilities that they are bringing to the market. And then there are vendors who are just bringing sheer capacity of data science skills to the market and they are coming in from a completely different angle of basically just renting the expertise of their data scientists into the market.

The market is incredibly fragmented. We are in the early stages of growth in the market. Every single one of our clients is building this capability internally and they are looking for more services from vendors, because the opportunity to apply analytics is in every single one function whether it is a customer analytics, industrial Internet, e-commerce platform, is growing. Analytics is embedded into literally every single business interaction.

BI, Analytics [and Big Data] Market Sizing

More recently to support a new generation of cost cutting and growth initiatives, corporations are investing heavily to gain near real-time actionable insights (historical and predictive), and from a mix of disparate spreadsheets and myriad of systems (legacy, internal silos, customer facing, suppliers, partners, etc.).

Another way to look at BI is the type of questions being asked and answered. The simplest model developed by TDWI is shown here.

According to a Gartner report, the software market for BI, analytics and corporate performance management grew by 16.4% in 2011 to $12.2 billion in 2012 and 14.1 in 2013.

Companies are investing in software platforms to answer 3 critical performance questions: How are we doing? Why? What should we be doing?

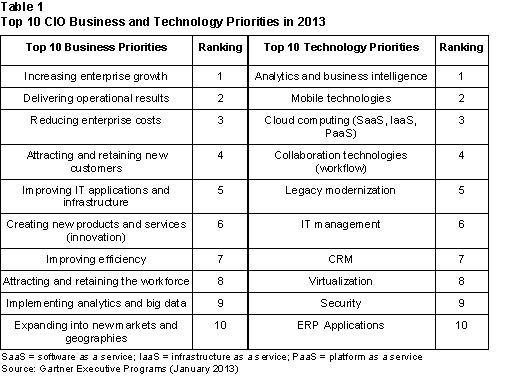

This category is expected to have robust growth as BI and Analytics are rated #1 priorities in corporate IT. Also new growth is coming from the Big Data — integrated appliances like Oracle Exadata, IBM Netezza, SAP HANA, EMC GreenPlum. I also see explosive growth in industry specific analytics categories like retail customer/predictive analytics.

BI platform software sales was tallied at $7.79 bln. Gartner identified SAP revenue as $2.88 billion, up 19.5 percent from 2010). SAP is the market share leader in the BI, analytics, and PM software space. Second is Oracle, with $1.9 billion in 2011 revenue, which, along with third-ranked SAS Institute ($1.54 billion in 2011 revenue) saw a dip in market share. IBM registered $1.47 billion in software revenue in 2011 and 12.1 percent of the market share to come in fourth, and Microsoft totaled $1.05 billion in 2011 revenue with a steady 8.7 percent of the market share.

IBM’s marketshare (via acquisitions) is definitely increasing as it accelerates its rapid-fire acquisition strategy to penetrate the market: Cognos, Netezza, SPSS, ILog, CoreMetrics, Algorithmics, OpenPages, Clarity Systems, Emptoris, DemandTec (for retail). IBM also has other complementary assets like Watson, DB2 etc. They are building a formidable capability around the value chain: “Raw Data -> Aggregate Data -> Intelligence ->Insight -> Decisions” . They see this as a $20Bln opportunity in managing the data, understanding the data and then acting on the data.

Gartner’s Market Analysis

According to Gartner’s report, the Big 5 vendors (SAP, Oracle, SAS, IBM and Microsoft) continue to dominate, owning 68 percent of the market share. In the BI platform and CPM suite segments, they hold close to two-thirds market share, while in pure statistics and analytic applications, SAS dominates the market.

According to Gartner’s report, the Big 5 vendors (SAP, Oracle, SAS, IBM and Microsoft) continue to dominate, owning 68 percent of the market share. In the BI platform and CPM suite segments, they hold close to two-thirds market share, while in pure statistics and analytic applications, SAS dominates the market.

There is ongoing BI tools consolidation (Visualization, ETL, Reporting, Datawarehouses) in the IT departments, while, at the same time, a new wave of lighter footprint data visualization tools and analytic applications are proliferating in line of business units. In-memory and Mobile BI are two new categories that are growing rapidly. We have seen a tremendous amount of interest in customers for iPad based analytics (CxO analytics).

Business users care less about who they buy from; they want easy-to-use, domain-specific functionality and speed-to-market. Business users don’t want long deployment cycles. Growing frustration with BI application performance, availability and latency are causing a spurt of investment in purpose-built data appliances like Oracle Exadata.

Gartner Analyst Dan Sommer remarked that the growth reflected uptake of an “information-driven” approach. ““It is clear that BI continues to be a technology at the center of information-driven initiatives in organizations,” he said. We expect faster category growth in 2012, 2013 and 2014 as companies make more pro-growth investments and also make catchup data and BI infrastructure investments as they come of the deep 2008-2009 recession.

Detailed Marketshare Data

The detailed marketshare data looks like this.

While the Gartner estimate is only for software and doesn’t include Systems Integration, Professional Services and specialized software/hardware (Big Data [e.g., Hadoop], BI appliances, Solid State Devices (SSD)).

Also it not clear if Gartner is including new emerging areas like Social Media Analytics, Analytics-as-a-service in their estimate. IDC says the Analytics market is a 51B business by 2016.

Also it is not clear if they are including industry specific analytics spend. For instance in retail I see significant investments in areas like Markdown, Customer and Web Analytics that are provided by specialist firms.

A good example is dunnhumby in U.K which is used by many large retailers like Tesco, Kroger, Macy’s for loyalty database management, pricing and markdown analytics, and data mining.

The numbers don’t include the massive investment in peta-bytes of storage that is being driven by Analytics. Large “cloud” or virtual storage models and storage tiering—the process of moving stored assets according to their value— are being implemented everywhere to drive down costs and improve resource utilization.

We estimate that the BI, Analytics and CPM market is closer to $50 Bln with these included. This is becoming a growing category in the overall global technology marketplace estimated to be $1.8 Trillion (excluding Telecom Services).

According to the Gartner report, “The global recession that swept the world had a major impact on markets and for a period of time, especially the first half of 2009, paralyzed them. While IT spending overall was negative during that time, the BI market managed to grow 4.2 percent in 2009.

In 2010, the global resurgence from various economic stimulus packages, general improvement in the macroeconomy and new product releases contributed to a surge in spending. As a result, BI software growth accelerated to 13.4 percent in 2010. As BI spending has far surpassed IT budget growth overall for several years, it is clear that BI continues to be a technology at the center of information-driven initiatives in organizations.”

Gartner Magic Quadrant – 2009, 2010, 2011

BI Spending Growth Drivers

The Analytics Chain: Know Where You Are –> Know Where You are Going –> Know How to Get There –> Know When You Got There

BI is the fastest growing opportunities in the IT market. BI growth is being fueled by five factors:

1) Performance, availability and latency issues in current BI solutions is causing a growth spurt in Data Appliance category (e.g., Oracle Exadata, EMC Greenplum, IBM Netezza etc.). Performance improvements come from offloading I/O intensive processing to a purpose-built appliance which uses caching and other techniques to dramatically improve latency of apps like SAP BusinessObjects.

2) Business demand for rapid access to new insight. Pressure to leverage real-time insights is spurring the investment and development of fast, what-if planning tools and in-memory analysis capabilities. It has also fueled interest in predictive analytics to get out ahead of emerging demand, risk and opportunity. Mobile delivery, cloud computing (analytics-as-a-service) and Big Data would also figure heavily in coming years. These are still emerging areas, far short of widespread implementation.

3) Speed of the upgrade cycle. Many enterprise customers are now faced with what seems to be a Hobson’s Choice – sticking with an older (fully or partially depreciated) but more stable version of BI Platform that SAP, Oracle and others may soon no longer support, or moving to a costly, supported newer version but potentially hobbled by bugs and instability.

4) Continued investments in foundational data and information management (IM), the below the waterline and messy part behind BI. IM includes data discovery, modeling, integration, data cleansing and database optimization—all difficult, time-consuming challenges.

5) Consolidation and M&A Integration. Invariably just when IT gets its arms around existing information, it seems the business side invariably hits the reset button on BI and IM demands by merging with or acquiring another company. This usually causes several new projects.

According to David Kreutter, VP, US Commercial Operations at Pfizer Inc., “We’re taking analytics from a planning perspective to a planning, execution and evolution perspective. As a result, analytics has become much more operational than it’s been in the past.”

Top Vendors According to Gartner

Summary

The future belongs to the companies who figure out how to manage the entire data life cycle – where it comes from, how you collect and use it, and where it goes – successfully.

Data was always king but BI has amplified its importance. BI tools are making data easier to manage, store, maintain and classify. Better access to data is allowing businesses to employ evidence-based decision making at all levels of their organizations. The ease of collecting data is driving organizations to look at how they can best use the information.

The race is on to provide… Relevant Information, Better Outcomes, Smarter Decisions, and Actionable Insights.

Notes, Links and Sources

- Gartner Says Worldwide Business Intelligence, Analytics and Performance Management Software Market Surpassed the $12 Billion Mark in 2011

- For a look at the vendor landscape that makes up these numbers see – The Vendor Landscape in BI and Analytics.

- see this blog posting for an analysis of Gartner and IDC BI data: http://www.enterpriseirregulars.com/22444/decoding-bi-market-share-numbers-%E2%80%93-play-sudoku-with-analysts/

- The Pfizer quote is from MIT Sloan Management Review: How Pfizer Uses Tablet PCs and Click-Stream Data to Track Its Strategy

- IBM CIO Study: BI and Analytics are #1 Priority for 2012 — https://practicalanalytics.wordpress.com/2011/11/02/ibm-cio-study-bi-and-analytics-are-1-priority-for-2012/

- Gartner Slashes 2012 Global IT Spending Forecast

Definitions of Different BI Categories

- Corporate/enterprise performance management software and performance management concepts, such as the balanced scorecard, enable organizations to measure business results and track their progress against business goals in order to improve financial performance.

- Business intelligence (BI) is a necessary business competency for improving decisions and performance. the most widely used BI tool is the spreadsheets. Traditionally, BI has been used for performance reporting from historical data, and as a planning and forecasting tool for a relatively small number of people in an organization. Modeling future scenarios permits examination of new business models, new market opportunities and new products, and creates a culture of opportunity.

- Data visualization tools, include mashups, executive dashboards, performance scorecards and other data visualization technology, is becoming a major category.

- Data analytics software and advanced analytics techniques, including predictive analytics, text analytics and text mining, customer analytics and business intelligence – customer, supply chain – data mining, can help organizations make sense of — and gain a competitive advantage from — all the data that they have in their systems.

- BI platforms provide a range of capabilities for building analytical applications. Examples are Oracle OBIEE, SAP Business Objects 4.0. There are many choices and combinations of BI platforms, capabilities and use cases as well as many emerging BI technologies such as in memory analytics, interactive visualization and BI integrated search. The idea of standardizing on one supplier for all of one’s BI capabilities is difficult to do. Increasingly, standardization and more about managing a portfolio of tools used for a set of capabilities and use cases.

- Data integration tools and architectures in support of BI continue to evolve. Extract-Transfer-Load (ETL) tools make up a big segment of this category in addition to data mapping tools. Organizations must now support a range of delivery styles, latencies, and formats.

Related articles

- IDC: Analytics a $51B business by 2016 thanks to big data

- Predictive Analytics 101 (quick overview)

- What’s Next In Analytics (informationweek.com)

- IBM CIO Study: BI and Analytics are #1 Priority for 2012 (practicalanalytics.wordpress.com)

- Oracle’s Analytics-as-a-Service Strategy: Exalytics, Exalogic and Exadata (practicalanalytics.wordpress.com)

- Gartner Says Fewer Than 30 Percent of Business Intelligence initiatives Will Align Analytic Metrics Completely With Enterprise Business Drivers by 2014 (gartner.com)

Trackbacks & Pingbacks

- Top 5 Internet Resources for Analytics Jobs « DECISION STATS

- Is Your BI Project in Trouble? | Business Analytics 3.0

- IBM CIO Study: BI and Analytics are #1 Priority for 2012 | Business Analytics 3.0

- How Small is BigData? «

- Network Planning Software on the Increase « News

- Gartner says – BI and Analytics a $12.2 Bln market | Funtowatch | Scoop.it

- Opportunities - Mu Sigma | Annotary

- Customer Analytics Market for the Best Customer Experience « Sales Leadership Institute

- Market Sizing – Analytics and Big Data | Business Analytics 3.0

- Billing Views| Network Planning Software on the Increase - Billing Views

Good analysis. The problem with going on revenue is that it discounts the share of homegrown or open source. It measures sales rather than overall usage and footprint. I’d also like to see if the SAS revenue data, for example, includes stats software as well as BI.

LikeLike

It’s no longer Business Intelligence! Gartner has acknowledged the market trend and dropped the unwieldy category name “Business Intelligence and Performance Management” in favor of the simpler umbrella term “Business Analytics”, following in the footsteps of other analysts (e.g. IDC) and vendors (Oracle, SAS, SAP, etc.).

It is no longer BI Competency Centers…. Gartner is also shifting from BI Competency Centers (BICCs) to Business Analytic Teams (BATs) – probably because the word “center” (a) doesn’t really represent the reality of diversified real-world organizational structures; (b) power shifting to the business units from centralized IT.

LikeLike

Qliktech growth is tremendous.. great going QV..

LikeLike

I’m excited to find this site. I wanted to thank you for ones time due to this fantastic read!! I definitely enjoyed every little bit of it and i also have you book marked to check out new information in your site.

LikeLike

Thanks for finally writing about >Gartner says – BI and Analytics

a $14.1 Bln market | Business Analytics 3.0 <Loved it!

LikeLike

Good

LikeLike